What Is The Federal Tax Rate For 2025

What Is The Federal Tax Rate For 2025. The federal income tax system is. The top 1 percent of taxpayers paid a 25.9 percent average rate, nearly eight times higher than the 3.3.

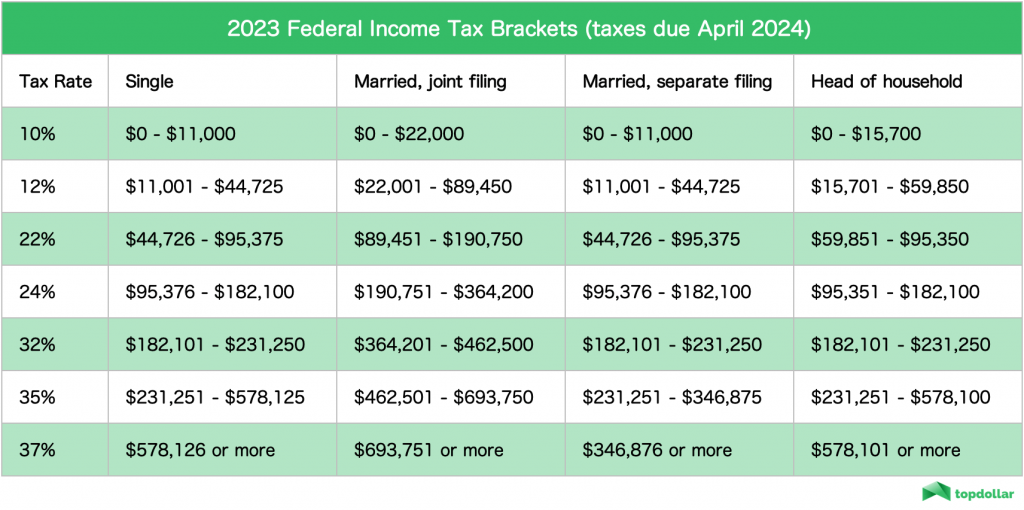

The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the. The federal income tax system is.

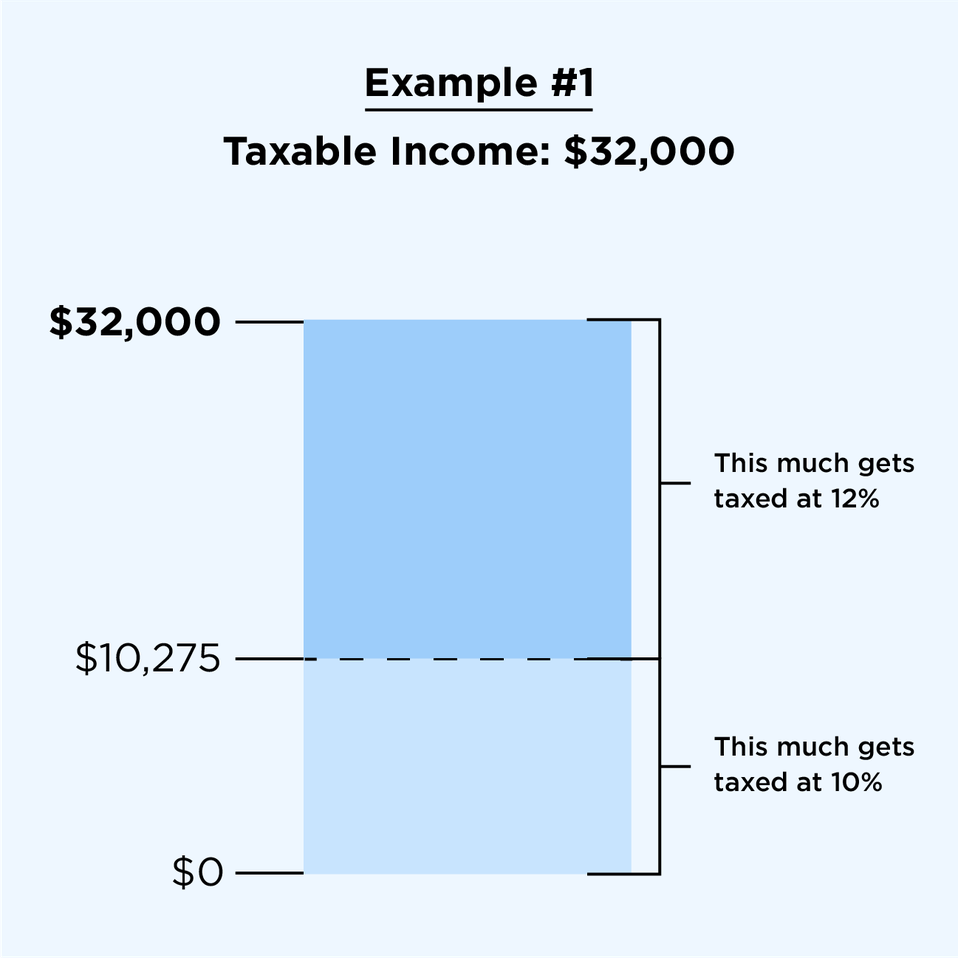

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37. Calculate your personal tax rate based on your adjusted gross income for the current.

Tax rates for the 2025 year of assessment Just One Lap, There are seven federal tax brackets for tax year 2025. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Tax Brackets 2025 Chart, For 2025, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2025. $3,500 x 0.22 = $770 federal tax withholding.

20222023 Tax Rates & Federal Tax Brackets Top Dollar, See current federal tax brackets and rates based on your income and filing status. 2025 federal income tax brackets and rates in 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Tax brackets 2019 vptiklo, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. For both 2025 and 2025, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

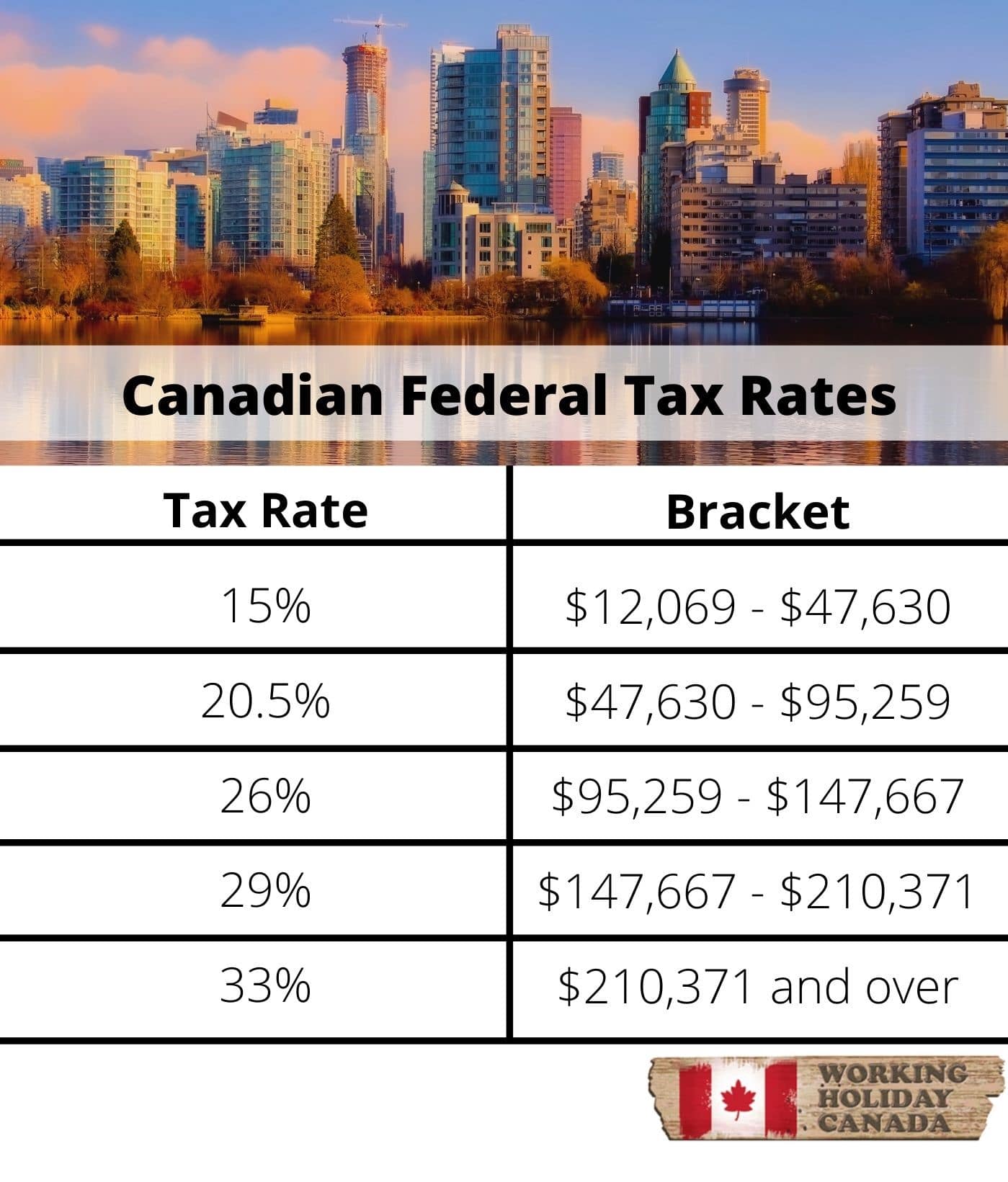

Tax Information Every US citizen Working in Canada Must Know, Below, cnbc select breaks down the updated tax. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37.

Where Can I Calculate tax? Aapka Consultant This, There's still more than a month before tax day but. The highest earners fall into the 37% range,.

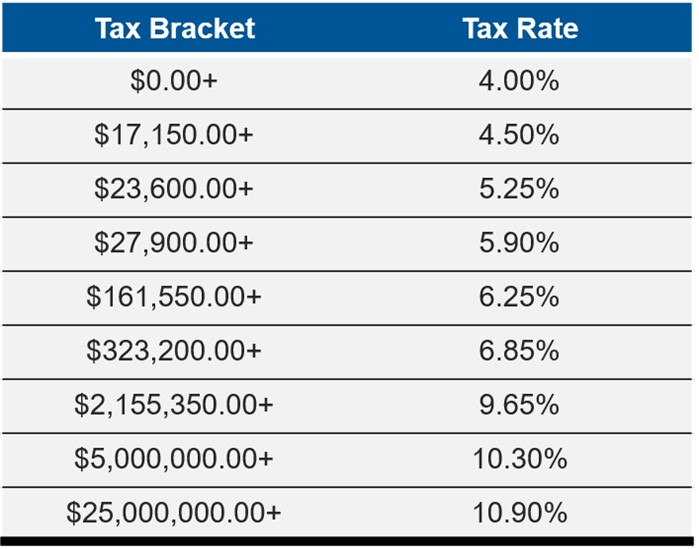

New York State Taxes What You Need To Know Russell Investments, $236 million (1.6%) american international group. $3,500 x 0.22 = $770 federal tax withholding.

2025 Irs Tax Chart Printable Forms Free Online, 10%, 12%, 22%, 24%, 32%, 35% and 37%. The 2025 tax year features seven federal tax bracket percentages:

2025 Tax Brackets The Best To Live A Great Life, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. Knowing your federal tax bracket is essential, as it determines your federal.

Income in america is taxed by the federal government, most state governments and many local governments.