Tax Calculator 2025 India Old Regime

Tax Calculator 2025 India Old Regime. Deductions from net annual value. It also lets you compare your tax liability under new tax regime and old tax.

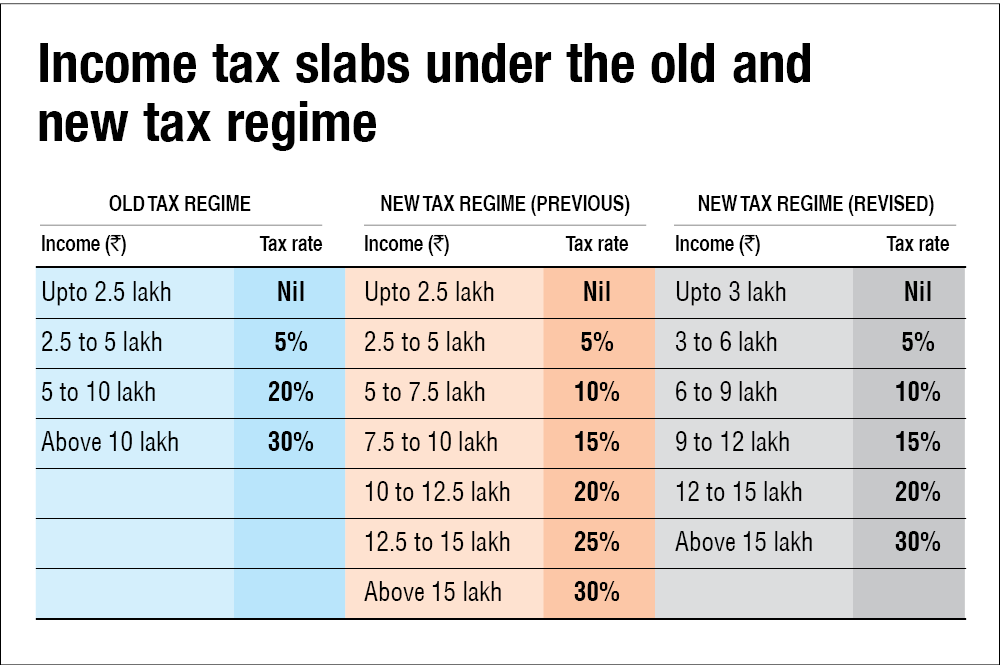

Refer examples & tax slabs for easy calculation. You can make use of this calculator for calculating tax liabilities as per old as well as new tax slabs.

The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances.

Tax Calculator India Old Regime Excel A Comprehensive Guide TAX, Anyone who has an income that crosses a specific threshold is required to pay taxes. Zero tax for individuals with a total income up to ₹7 lakhs or salary up to ₹7.5 lakhs.

Old Vs New Tax Regime Calculator 2025 Shawn, How to calculate income taxes online? Annual letable value/rent received or receivable.

Old Vs New Tax Regime Calculator Ay 202425 Elset Horatia, Expectations from fm sitharaman in the old and new tax regimes. Refer examples & tax slabs for easy calculation.

Old Vs New Tax Regime Calculator Ay 202425 Bee Merrily, Including marginal relief for new tax regime, surcharge, cess. Expectations from fm sitharaman in the old and new tax regimes.

New Tax Regime Vs Old Which Is Better For You? Rupiko Peoplesoft, You can make use of this calculator for calculating tax liabilities as per old as well as new tax slabs. These benefits, such as the exemption for house rent allowance, deduction for housing loan interest, and provident fund contributions for.

Old or new? Which tax regime is better after Budget 202324 Value, Expectations from fm sitharaman in the old and new tax regimes. 5 lakh and up to rs.

Tax Calculation Statement Form 2025 25 Image to u, 5 lakh and up to rs. These benefits, such as the exemption for house rent allowance, deduction for housing loan interest, and provident fund contributions for.

Tax rates for the 2025 year of assessment Just One Lap, How to calculate income taxes online? Individuals falling under the taxable income bracket are liable to pay a specific portion of their net annual income as tax.

New Tax Regime Vs. Old Tax Regime Which one to pick? finansdirekt24.se, Thus, while the basic exemption limit is rs. Updated per latest interim budget 2025 rules.

Opt new tax regime if deduction, exemption claims less than Rs 3.75, Anyone who has an income that crosses a specific threshold is required to pay taxes. The salary tax calculator will help you save precious time and money by instantly giving you an estimated figure.